Income Statement Closure in Microsoft Dynamics NAV

At the end of a reporting period, an accountant of a company must perform the income statement closure procedure. With respect to this need, Microsoft Dynamics NAV provides “two-click” functionality that makes this process quick, accurate and easy. However, do we understand why this procedure is required and what exactly is behind it? Let us examine the logic behind this process.

Double Entry Principle

To begin with, let us refresh the basic principles of accounting. If we post any transaction in NAV, for example a sales invoice, and then look at the resulting general ledger entries, we will see at least two entries.

Why so? The answer is, the accounting process rests on a major principle – double entry bookkeeping system. The goal of most businesses is to make profits; therefore, resources are never spent for no reason.

By this logic, if we spend our resources, we want to get something in return. If we receive resources, we must give or do something in return.

Imagine two hands. One hand takes money from one pocket and the other puts the received item or service in the other pocket. The goal of accounting is to track what each of the hands does and what remains in the pocket.

For every ‘-‘ there must be a ‘+’. So, in this system, the accountant makes at least two entries with equal amounts: one debit and one credit entry in order to record a financial transaction. The number of general ledger entries for one transaction may be more than two, but the principle will remain the same: every ‘-‘ will match every ‘+’.

Balance Sheet and Income Statement

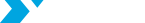

Now that we know that the goal of double entry

accounting is to track the activity of the hands and contents of the pockets, let

us look at what form this information is collected into. The collected reports

about the company’s activity and its results are referred to as financial

statements, namely the balance sheet and income statement. The financial

statements are then used for company’s performance analysis by banks, the tax

authorities, investors, creditors, and management. Therefore, the accuracy and comprehensiveness

of the disclosed information is an essentiality.

The major difference between the balance sheet

and income statement reports is that the balance sheet accumulates the results of a company’s activity

throughout its entire existence, while the income statement reflects the activity itself and only during the current

reporting period. Reporting periods can vary - month, quarter, semester, year,

depending on the local reporting regulations, but the logic is always the same:

the balance sheet represents accumulated results, while income statement

represents activity in the current reporting period.

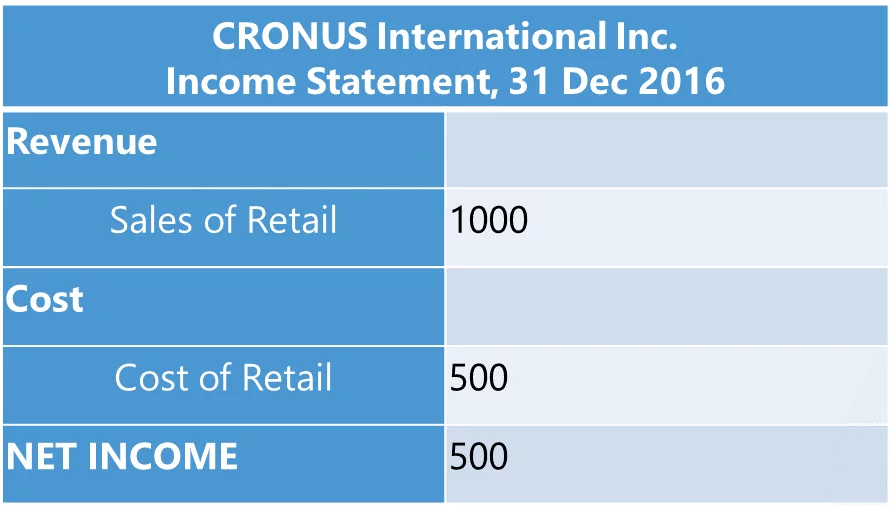

The formula of the income statement is quite simple: Revenue-Cost=Net Income. If we buy for 10 and sell for 20, the net income is 10. No need to go into explanations.

The balance sheet logic works a little bit differently: Assets = Liabilities +Stockholder’s Equity, where assets represent everything the company owns (such as cash, inventory, property) and liabilities and stockholder’s equity represent the source of the company’s resources.

To understand the balance sheet better, imagine that you have $100,000 on your bank account, and you are considering buying a fancy car. The money is your asset, because you own it. But wait a minute, where did you get that money from? If you have got it from your grandmother as a gift, then no need to worry if you already paid your taxes; this is your own property, or, in other words - stockholder’s equity. But what if you borrowed that money from a bank 3 years ago and the loan is due next week. In this case, your personal the balance sheet will reflect $100,000 in the liabilities. Perhaps buying a car would not be the wisest decision in this case. Companies use balance sheet information for decision making in a similar way. Big assets will not always be a sign of a company’s good health. However, looking at whether assets are sourced with liabilities (debts) or stockholder’s equity (own sources) will provide an accurate picture.

Now that we understand the importance of the balance sheet and income statement for companies, let us examine a simplified example showing how transactions are recorded and then collected in the financial statements.

The Story of One Bicycle

Suppose CRONUS International Inc. has been founded in year 2015. The stockholder invested $500 into the company’s capital, which has been recklessly spent on a purchase of one bicycle.

The balance sheet of the company looked as follows:

On 1 January 2016, the company has no other property but only one bicycle in its inventory, the value of which is $500.

During 2016 CRONUS International Inc. sells the bicycle for $1000 and receives the money on their bank account.

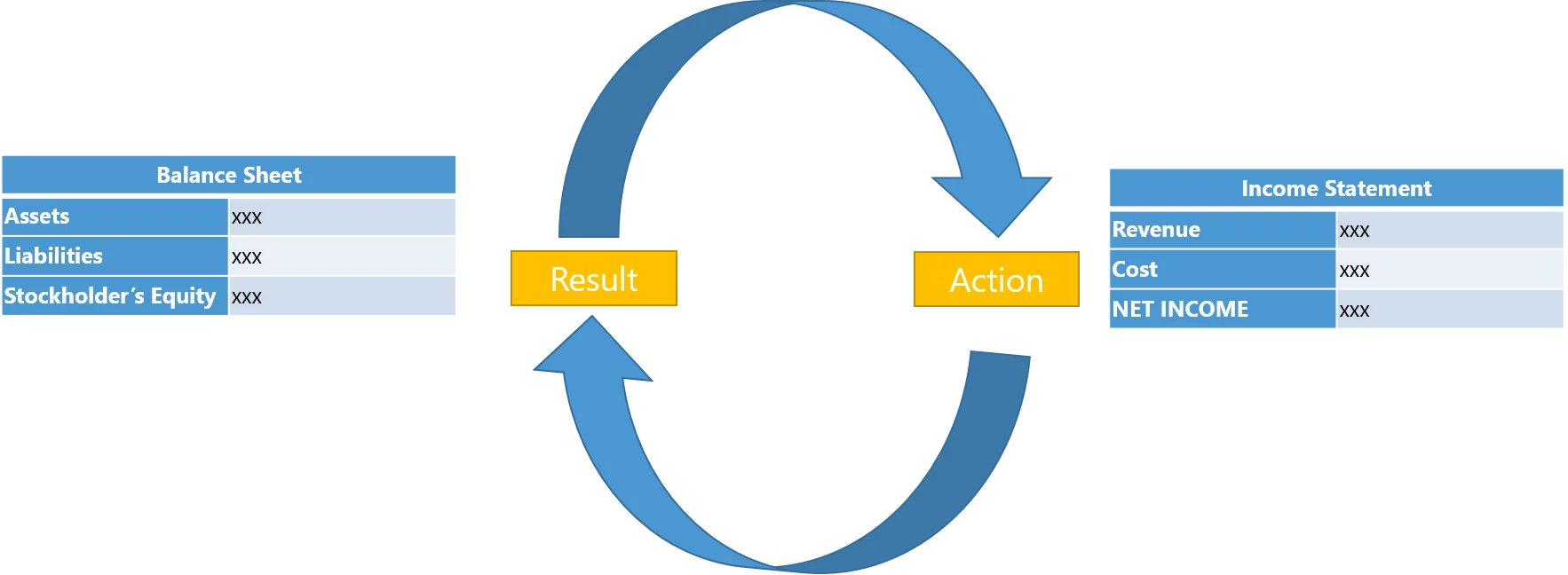

The accountant would make the following journal entries in his journal to post this transaction:

Pay attention to the sums in the Debit and Credit columns. Correctly recorded transactions will always result in debit-type records matching credit -type records.

At the end of year 2016, the accountant prepares the income statement and balance sheet. Here is how the posted transactions will affect the balance sheet and income statement:

What about the balance sheet?

Remember the formula Assets= Liabilities +Stockholder’s Equity? Although the accountant posted all transactions correctly and transferred new balances to the balance statement, the assets section is not equal to the sum of the liabilities and the stockholder’s equity section. If an investor looked at this balance sheet, he would know the information for 2016 is incomplete and no conclusion about company’s health can be made. The reason of this situation is that the accountant did not transfer the results of the activity to the balance sheet.

We have approached the point at which the income statement closure needs to be performed.

Income Statement Closure

In order to achieve balance between assets and liabilities stockholder’s equity sections, the accountant needs to transfer the result of the activity, or more specifically, the balance of the net income account in the income statement, to the balance sheet. The balance sheet account that accumulates the results of the company’s activity, which, by the way, can be both profits and losses, is the retained earnings account and is located in the Stockholder’s Equity part. If the retained earnings account is negative, perhaps the company has been having hard times for a while.

In order to close the income statement, the accountant must make sure that all transactions have been posted and the account balances are final.

Below are the transactions that will transfer the balances on the accounts in the income statement to the retained earnings account.

After the accountant has transferred balances

from the balance sheet to the income statement, the balance sheet looks as

follows:

The balance sheet now balances. This is what

closing of the income statement is all about. As mentioned previously, this

procedure can be done with any periodicity, depending on the standards under

which the company is reporting.

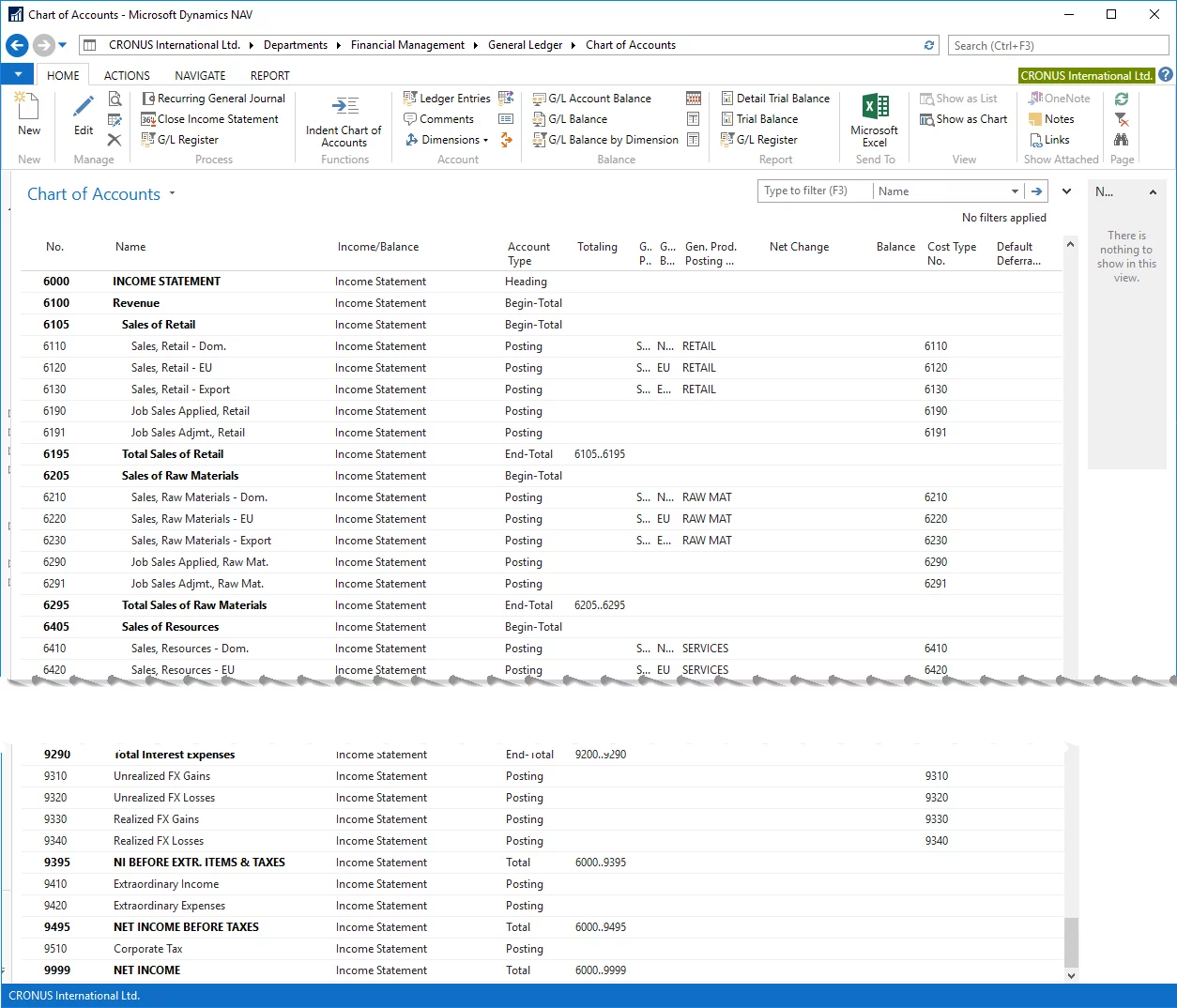

Closing Income Statement in Microsoft Dynamics NAV

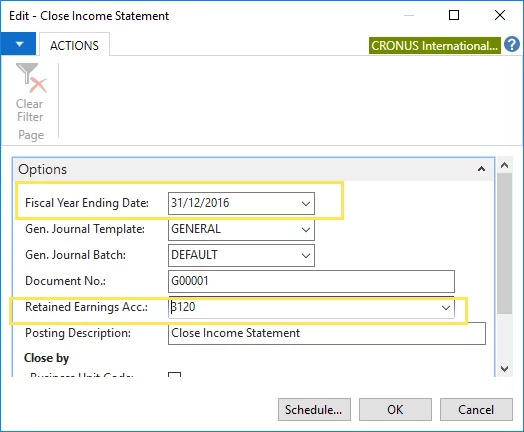

Suppose the accountant of the CRONUS

International Inc. uses Microsoft Dynamics NAV to record transactions and to

close the income statement. At the end of the reporting year, he runs the batch

job Close Income Statement (We are

not going into detailed walk-thorough here, as Microsoft online Help articles

provide exhaustive instructions on this topic).

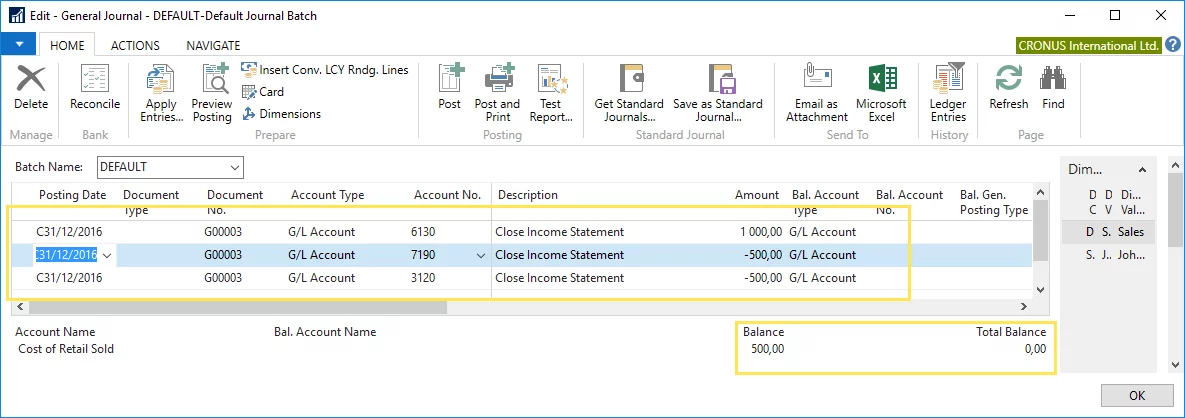

The batch job automatically creates journal

lines that will transfer the balances on the income statement to the retained

earnings account on the balance sheet. Notice that the Total Balance is 0,

which means that all debits match the credits, which is in line with the

principle we have reviewed.

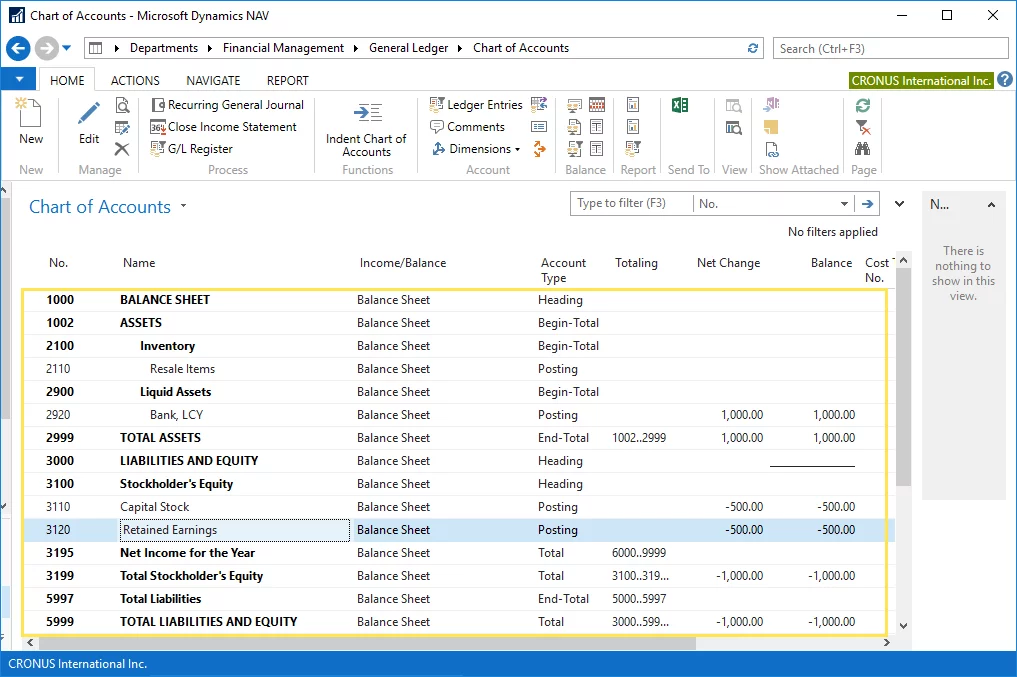

After the accountant posted the journal lines,

the balance sheet retained earnings account is updated with the result of the operational activity in 2016, so that the retained

earnings account contains financial results (net income) of the year 2016.

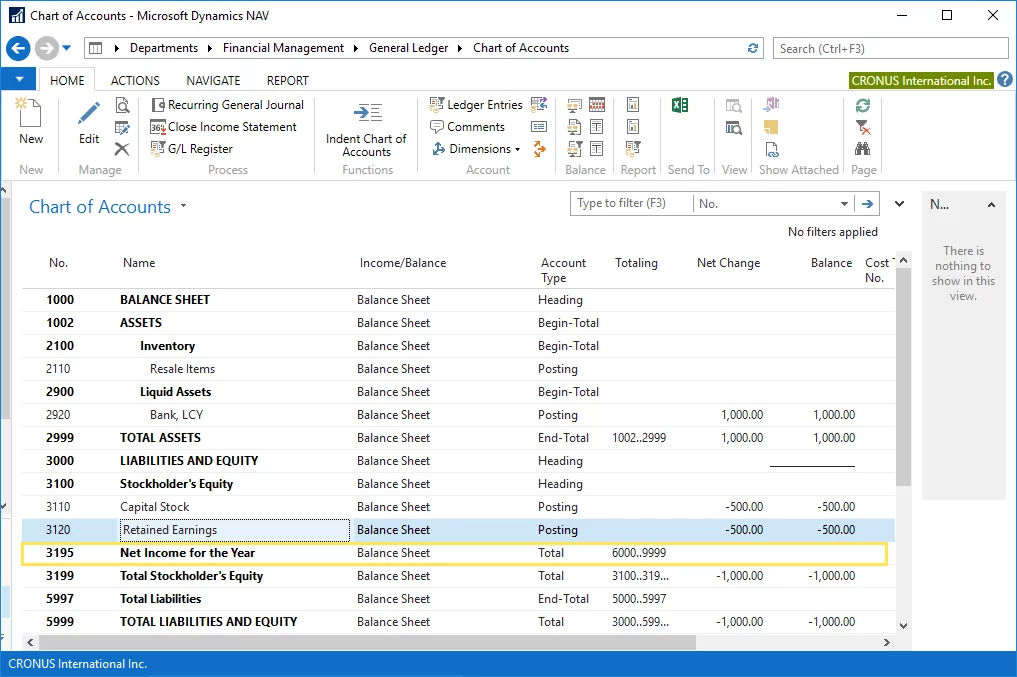

You may feel like asking how come that in Microsoft Dynamics NAV the balance sheet is always balance, even before the accountant performs income statement closure. If we look at the section Stockholder’s Equity in the chart of accounts, we will find another account Net Income of the Year.

This account accumulates the financial result

of the current reporting period (or sum for all unclosed reporting periods,

which can but ideally should not be more than one) until the income statement

closure activity is performed. Pay attention that this account is the Total type and totals the balances on

accounts 6000 through 9999, which, in our example, is the whole range of the

income statement accounts.

Once the accountant posts the closing journal lines to the retained earnings account, the balance of the Net Income for the Year account becomes 0, due to the reason that after the income statement has been closed, all of the income statement account balances are cleared.

So, that's it and for the summary purpose let's just sum up the key takeaways:

- Double entry principle requires accountants to record a ‘+’ for every ‘-‘.

- The income statement displays financial information related to activity per single reporting period and must be closed at the end of the reporting period.

- The balance sheet accumulates results of activity throughout the company’s existence.

- Companies must do their best to provide accurate and comprehensive information in the financial statements.

- The balance sheet formula: Assets = Liabilities + Stockholder’s Equity.

- The income statement formula: Revenues -Costs = Net Income.

- Income statement closing in Microsoft Dynamics NAV follows the pattern of accounting activities an accountant would perform manually and is easy to understand and track.